How Tariffs Impact Electronics Manufacturing

FlashPCB's Tariff Overview

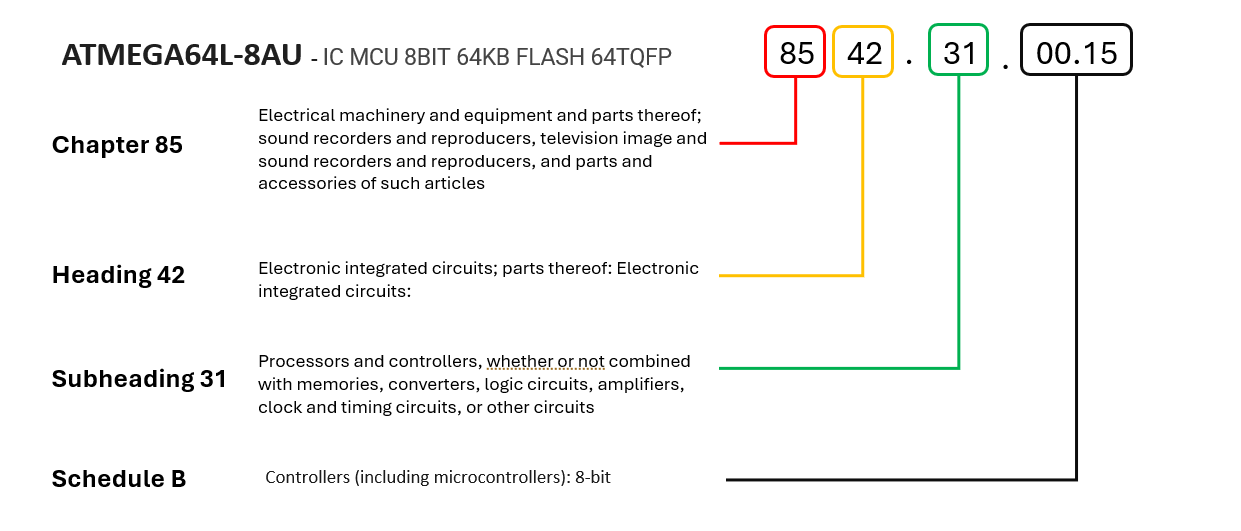

HTS Classification Example

HTS Classification Example

Tariffs, simply put, are taxes on imported goods. However, understanding exactly how tariffs are calculated and how they are paid can be more complex. Four main factors determine the cost to the importer:

-The type of goods imported

-The country of origin

-The value of the goods being imported

-How the tariff is paid

Harmonized System (HS) Codes & U.S. Schedule B

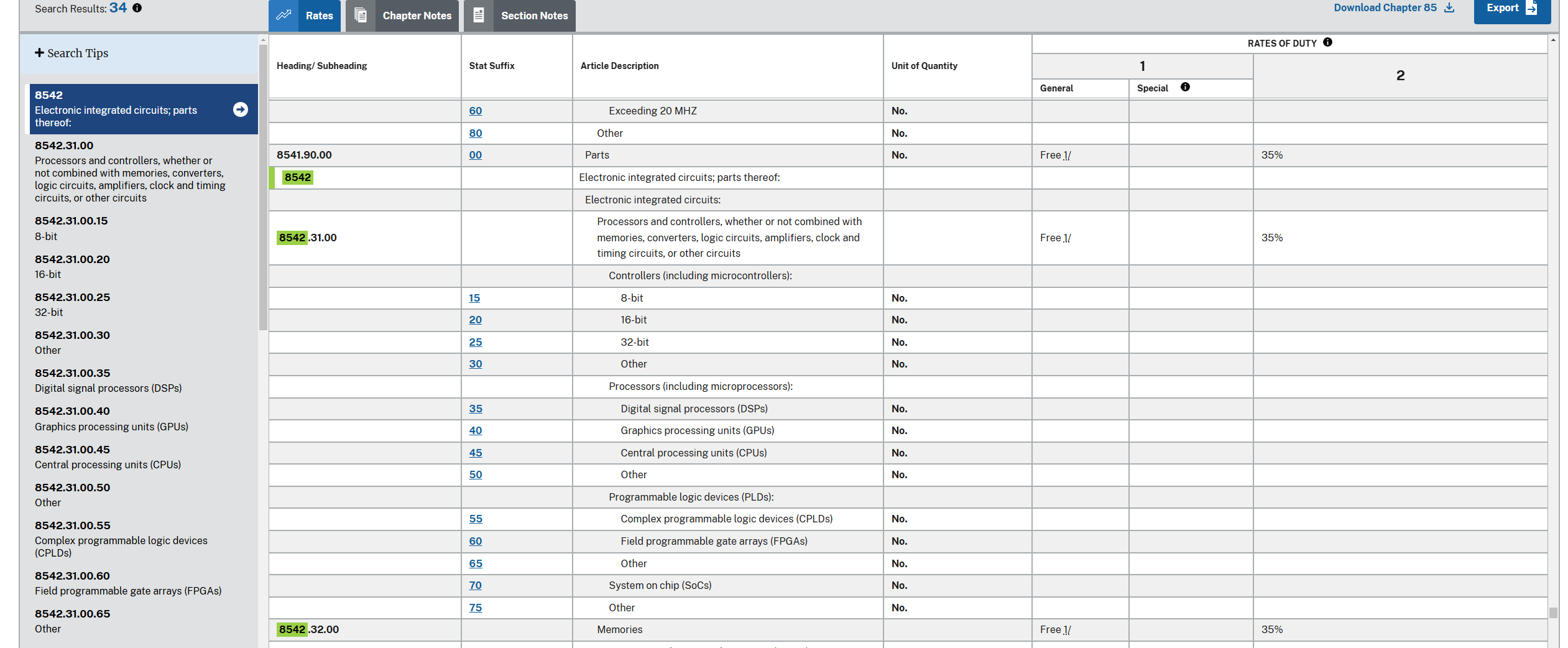

Every imported good is classified by a six-digit Harmonized System (HS) code plus an additional four digits for the U.S. Schedule B number. The first two digits of the HS code represent the chapter, the next two represent the heading, and the final two represent the subheading, as defined by the World Customs Organization’s (WCO) Harmonized Description and Coding System (HS). The U.S. Schedule B codes are maintained by the Census Bureau and can be found on their official website: https://hts.usitc.gov/

Printed Circuit Board Assemblies are found under Chapter 85, Heading 34, while integrated circuits are also found under Chapter 85, Heading 42.

Country of Origin

In the Harmonized Tariff Schedule (HTS), once the HS code is determined, there are two duty rates listed in two columns, based on the country of origin of the imported goods:

-Column 1: Countries that have normal trade relations (NTR) with the United States.

-Column 2: Countries that do not have normal trade relations with the United States, currently including Cuba, North Korea, Russia, and Belarus. Goods from these countries are subject to higher duty rates, which appear in Column 2 of the HTS.

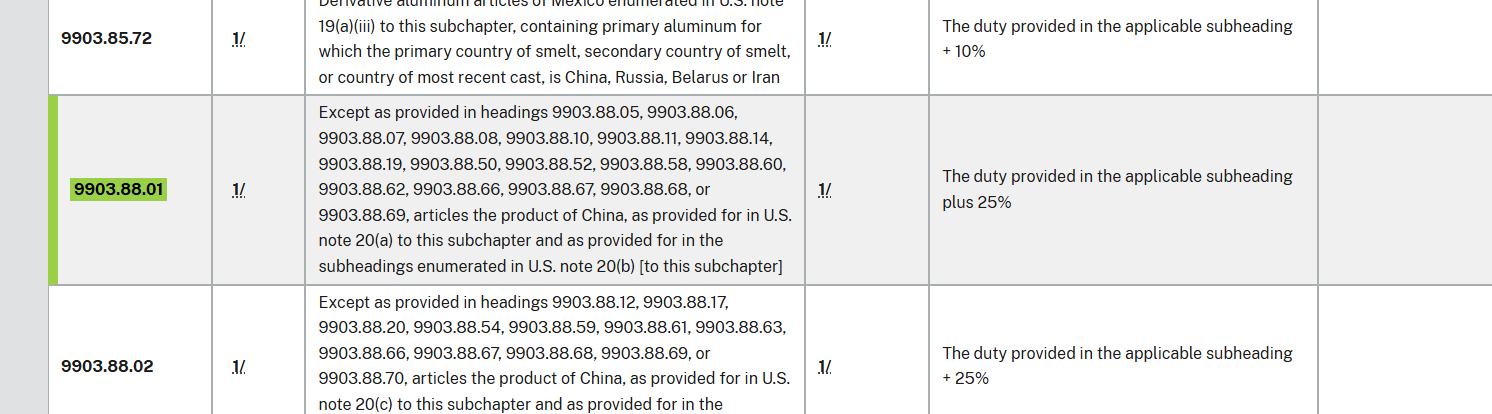

Additionally, the HTS may include notes that impose extra duties beyond those shown in Column 1. For example, there is a general note referencing 9903.88.01 in the HTS, which specifies an additional 25% tariff on most goods originating from China.

Goods Value and the “De Minimis” Exception

The most common type of tariff is an ad valorem tariff, which is a percentage of the value of the imported goods. However, some goods also have specific tariffs, which impose a fixed amount per unit or quantity. Goods may even be subject to compound tariffs, combining both ad valorem and specific rates.

The de minimis exception allows packages valued below a certain threshold to enter the country duty-free. In 1996, the World Customs Organization (WCO) introduced its Immediate Release Guidelines, recommending that member states adopt a de minimis threshold—recognizing that the cost of enforcing tariffs on low-value shipments often outweighs any revenue gained.

In 2015, under the Trade Facilitation and Trade Enforcement Act (TFTEA), the United States raised its de minimis threshold from $200 to $800. Executive Order 14195 of February 1, 2025 has since eliminated this exception for goods from China.

How Are Tariffs Paid?

In the United States, U.S. Customs and Border Protection (CBP) is the primary government agency responsible for collecting tariffs from importers. For shipments handled by UPS, FedEx, DHL, or USPS, these carriers often act as brokers for their customers. They typically pay the tariff on behalf of the importer and then bill the importer for the tariff plus a brokerage fee (for UPS, this fee is $55 per package).

While companies may handle tariff costs in various ways, it is common in the electronics industry to list the tariff as a separate line item that is passed on to the customer.

An Example

If we import a $100 four-layer panel from China, under HS Code 8534.00.00.20, the Column 1 tariff is 0%. However, there is an additional 25% tariff under 9903.88.01, as well as an additional 10% tariff imposed by Executive Order 14195 of February 1, 2025. On top of these tariffs, UPS charges a $55 fee to process the payments. Consequently, a $100 panel ends up costing $190 in total, reflecting $35 in tariffs and $55 in fees.

Tariffs at FlashPCB

FlashPCB is an American manufacturer, so there is no duty on the value of our goods shipped to our U.S. customers. However, we do face tariffs on certain goods used in the Printed Circuit Board assemblies we manufacture. We have factored these tariffs into the cost of our components, while the panels we import for our 10-day lead-time orders have typically fallen under the de minimis threshold. We may need to break these costs out as a separate line item if the de minimis threshold or tariff rate changes significantly.

Newsletter

For more information sign up at here.